Some Known Incorrect Statements About Offshore Wealth Management

Table of ContentsSome Known Incorrect Statements About Offshore Wealth Management Offshore Wealth Management Can Be Fun For AnyoneIndicators on Offshore Wealth Management You Need To KnowThe Best Strategy To Use For Offshore Wealth ManagementAbout Offshore Wealth Management

Offshore financial investments are usually an attractive solution where a moms and dad has actually supplied capital to a small, or for those who can expect their limited rate of tax to fall. They additionally give a benefit to financiers qualified to an age-related allocation, or expatriates who are spending while non-resident. Additionally, overseas services might be proper for investors desiring to invest routinely or as a one-off swelling amount into a variety of asset classes and also currencies.They can provide you with the choice of a normal revenue and also assist you to reduce your personal responsibility to Earnings and also Funding Gains Tax Obligation. The worth of a financial investment with St. offshore wealth management. James's Area will certainly be straight linked to the performance of the funds you select as well as the worth can for that reason go down as well as up.

The degrees and bases of taxation, as well as remedies for tax, can change at any moment. The value of any type of tax obligation relief relies on private conditions.

The Ultimate Guide To Offshore Wealth Management

Numerous financiers utilize standard investments like a real estate and financial items, at fixed prices. From the lasting investment viewpoint, it can be much better to spend in funding holders whose efficiency is constantly more appealing.

Counts on are excellent investment vehicles to protect properties, as well as they have the ability to hold a large array of possession courses, including residential property, shares as well as art or antiques - offshore wealth management. They also allow for reliable distribution of assets to beneficiaries. An offshore depend on that is managed in a secure jurisdiction enables for reliable wealth production, tax-efficient management and sequence preparation.

Offshore Wealth Management Can Be Fun For Anyone

Customers who are afraid that their properties might be iced up or taken in case of possible political chaos sight overseas financial as an attractive, safe way to protect their assets. Multiple overseas accounts thin down the political threat to their wide range and also minimize the danger of them having their possessions frozen or taken in a recession.

However, wilful non-declaration of the holdings is not. United States people are needed to declare assets worth over US$ 10,000 in overseas accounts. With raised their explanation tax obligation transparency and also firm of worldwide policies, it has come to be extra tough for people to open up overseas accounts. The global suppression on tax evasion has made offshore less eye-catching and also Switzerland, particularly, has actually seen a decline in the variety of offshore accounts being opened.

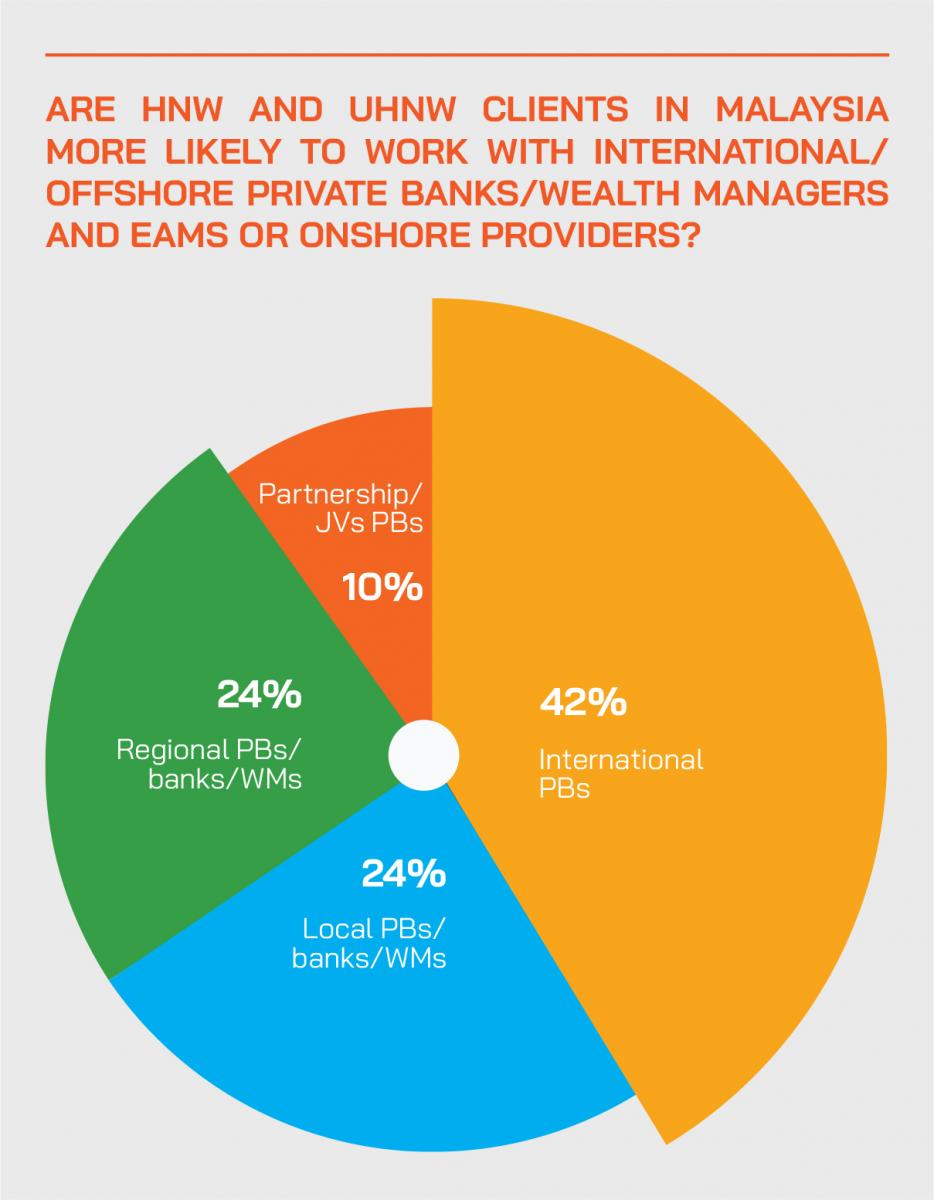

Onshore, offshore or a blend of the two will comprise a private banker's customer base. The balance for each and every lender will be various depending on where their customers desire to reserve their properties. Dealing with offshore customers calls for a slightly various strategy to onshore clients and also can include the complying with for the banker: They may be called for to go across borders to check out customers in their home country, even when the banks they come from does not have a permanent establishment located there, Possibly take complete responsibility for managing profile for the customer if the customer is not a resident, Be multilingual in order to successfully connect with customers and build their client base around the world, Have knowledge of worldwide legislations and laws, particularly with regards to offshore investments as well as tax obligation, Have the ability to connect their anchor clients to the right professionals to aid them with various locations from tax obligation with to even more practical assistance such as assisting with building, moving, immigration advisers and education and learning consultants, Understand the latest problems influencing international customers and guarantee they can produce options to meet their needs, The financial institution and details team within will certainly identify the populace of a banker's client base.

An Unbiased View of Offshore Wealth Management

Relates to the bigger monetary services sector in overseas facilities Offshore investment is the maintaining of money in a territory other than one's country of residence. Offshore jurisdictions are used to pay less tax obligation in lots of nations by large as well as small investors.

The benefit to overseas financial investment is that such procedures are both legal and much less costly than those used in the capitalist's countryor "onshore". Settlement of much less tax obligation is the driving pressure behind most 'offshore' activity.

Commonly, tax obligations imposed by a capitalist's residence nation are vital to the earnings of any kind of offered financial investment - offshore wealth management. Making use of offshore-domiciled unique function systems (or cars) an investor may decrease the amount of tax payable, permitting the capitalist to attain better productivity overall. Another reason that 'offshore' financial investment try here is considered exceptional to 'onshore' investment is because it is much less controlled, as well as the behavior of the overseas financial investment provider, whether he be a lender, fund supervisor, trustee or stock-broker, is freer than maybe in a much more regulated setting.

All About Offshore Wealth Management

Safeguarding versus currency decrease - As an example, Chinese capitalists have actually been investing their cost savings in stable Offshore areas to safeguard their versus the decline of the renminbi. Factors which have been progressed against offshore financial investment include: They bypass protection exchange regulations placed into area after the excellent depression (e.e. offshore wealth management., it can not be tired once more when re-spent to offer solutions and facilities). It urges Tax competition between states, districts, nations, as well as areas, in the same way that the look for ever less costly source of hands-on labor lowers wages anywhere. Offshore financial investments in inadequately managed tax sanctuaries might bypass assents versus nations established to motivate conventions vital to societies (e.Corporations are easily produced in Panama as well as, although they are greatly strained on Panama-domestic procedures, they pay no tax obligations on foreign activities. Company possession can be readily concealed with using confidential "holder shares". Therefore, greater than of 45,000 offshore covering business and also subsidiaries firms are developed in Panama each year; Panama has one of the greatest concentrations of subsidiaries of any type of nation worldwide.